The Architecture of Autonomy: Probabilistic Orchestration in Cortex

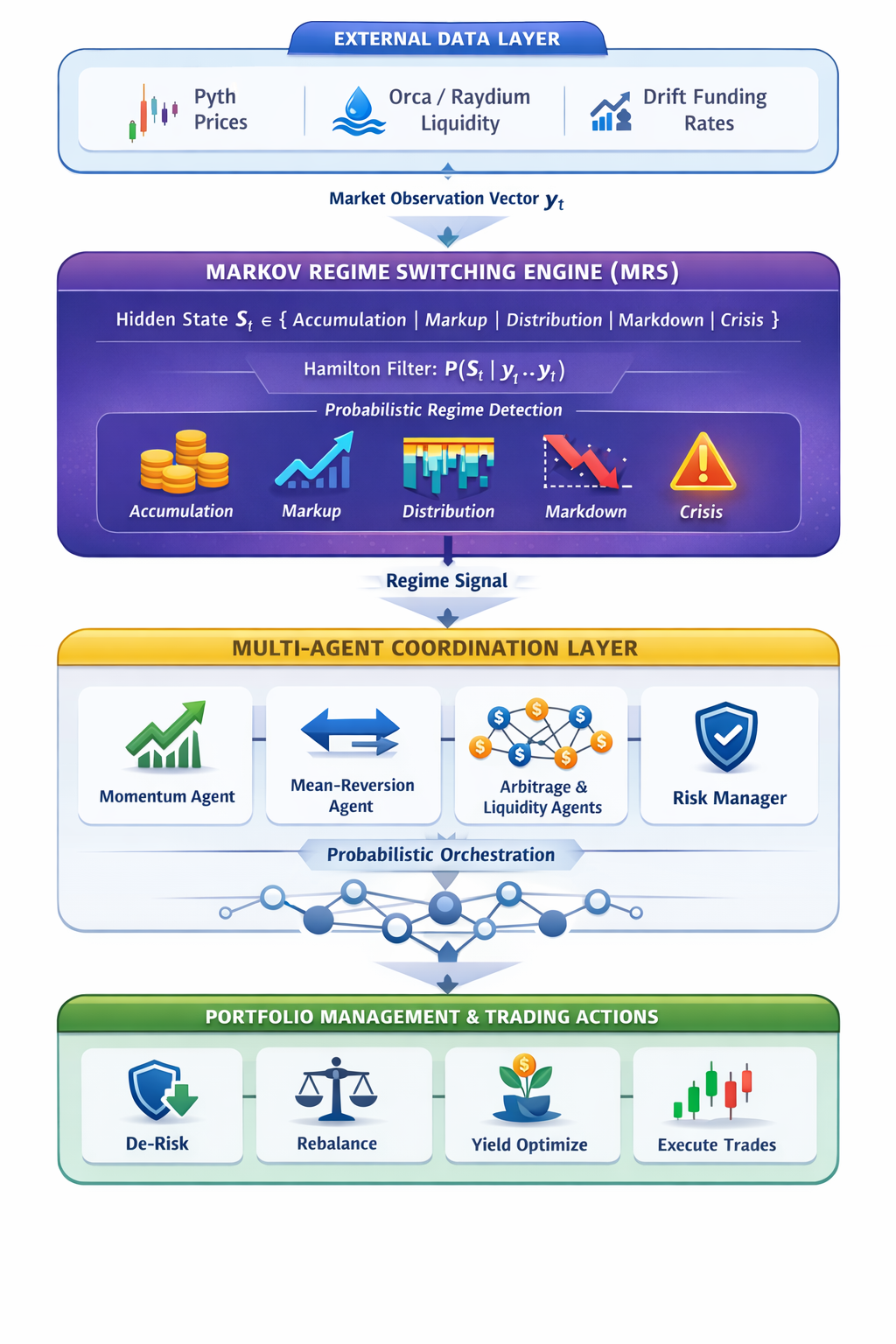

Traditional DeFi automation assumes “market stationarity”—the false idea that statistical patterns remain constant. The Solana ecosystem is actually defined by regime heterogeneity, where markets shift abruptly between distinct behavioral states. Cortex solves this using Markov Regime Switching (MRS) and a multi-agent autonomous architecture to create proactive trading infrastructure.

1. The 5-Regime Framework

Static strategies fail when they cannot perceive structural shifts. Cortex identifies five specific regimes based on liquidity and price action :

-

Accumulation: Sideways ranges where “smart money” builds positions.

-

Markup: Bullish trends with higher highs and public bidding.

-

Distribution: Ceiling formation and institutional selling.

-

Markdown: Cascading sell-offs where supply overwhelms demand.

-

Crisis: Parabolic volatility and liquidity dry-ups .

2. Markov Regime Switching (MRS)

Cortex’s core is the MRS model, which treats market states as unobserved variables governed by a Markov chain. Observed returns $y_t$ are conditioned on a hidden state $S_t$:

The system calculates the posterior probability of a regime at every step. This allows Cortex to be proactive: if the probability of a “Crisis” regime rises, it de-risks before the crash happens.

3. Multi-Agent Orchestration (MAS)

Intelligence is decentralized across specialized agents coordinated via a probabilistic orchestration layer. This layer constructs “belief states” under uncertainty rather than using simple if-then rules.

-

Momentum Agent: captures trends in Markup/Markdown.

-

Mean-Reversion Agent: trades ranges in Accumulation/Distribution.

-

Liquidity & Arbitrage Agents: optimize yield and capture cross-protocol spreads.

-

Risk Manager: enforces global safety constraints.

4. Solana Implementation & Comparisons

Cortex utilizes Solana’s 400ms block times to react with institutional-grade precision. It fuses data from Pyth Network (400ms intervals), Orca/Raydium (liquidity depth), and Drift (funding rates) .

-

Vs. Jupiter: Jupiter is an execution powerhouse (95% aggregator share), but requires user-led strategies.

-

Vs. Drift/Kamino: These offer powerful vaults but often lack the proactive, regime-aware risk shifts inherent in Cortex.

5. Tortoise Math: The Edge of Asymmetry

Markets climb slowly (avg. 25 months) but crash quickly (avg. 17 months). Cortex uses “Tortoise Math”: because a 50% loss requires a 100% gain to break even, the system prioritizes downside capture . By losing less during “fast crashes,” the system compounds significantly faster over the long term .